Understanding the Current Trends Pakistan’s inflation rate has been a topic of concern in recent years.

According to the latest data, the inflation rate in Pakistan decreased to 2.40% in January 2025 from 4.10% in December 2024 ¹. This decline is a positive sign, but it’s essential to delve deeper into the inflation index to understand the current trends

.Historical Context

Pakistan’s inflation rate has fluctuated significantly over the years. In 2023, the inflation rate was 30.77%, a 10.89% increase from 2022 ².

This surge was attributed to various factors, including currency devaluation, supply chain disruptions, and global economic trends.

Current Trends

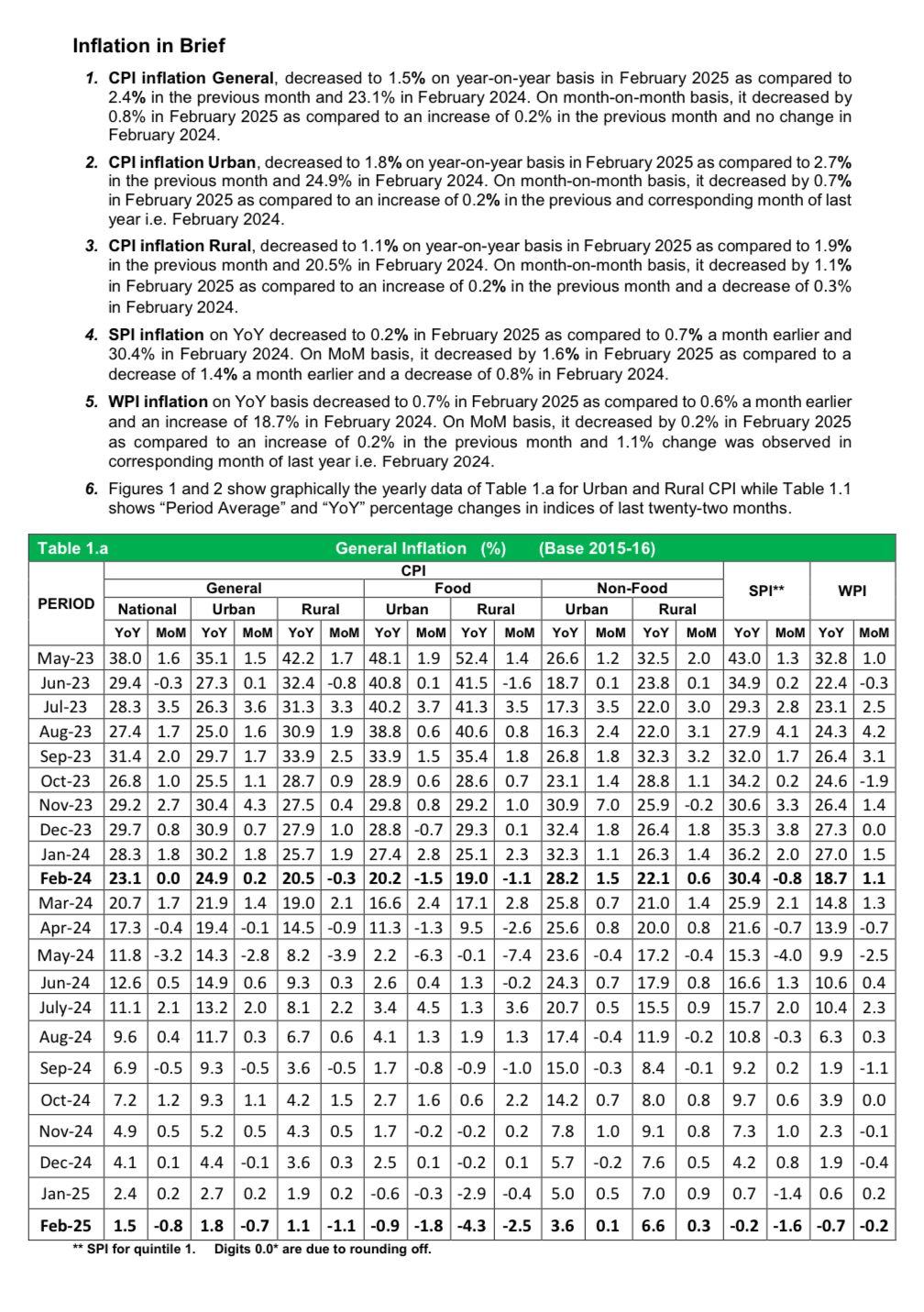

The Consumer Price Index (CPI) in Pakistan increased to 266.17 points in January 2025 from 265.63 points in December 2024 ³. This indicates a slight increase in consumer prices. The CPI is a crucial indicator of inflation, as it measures the average change in prices of a basket of goods and services

.Key Factors Contributing to Inflation

Several factors contribute to Pakistan’s inflation, including:-

_Monetary Policy_: The State Bank of Pakistan’s monetary policy decisions, such as interest rates and money supply, can impact inflation.-

_Supply and Demand_: Imbalances in supply and demand, particularly in the food and energy sectors, can drive inflation.- _

Global Economic Trends_: Pakistan’s inflation is also influenced by global economic trends, such as changes in oil prices and international trade policies.

Pakistan’s inflation index is a complex and multifaceted issue. While the recent decline in inflation rate is a positive sign, it’s essential to continue monitoring the trends and addressing the underlying factors contributing to inflation.

By doing so, policymakers can work towards maintaining economic stability and ensuring a better future for the people of Pakistan.

Top Trends Blogs

Top Trends Blogs